- Overview

- Features

- Solution

- Case studies

- Next step

Overview

Securing financial data against emerging cyberthreats

As the banking, financial services, and insurance (BFSI) sector shifts towards online transactions, it faces a critical challenge: protecting sensitive financial data and personal customer information. The transition to digital platforms significantly increases the risk of cyberattacks, leading to substantial financial losses and weakening customer trust. Additionally, the increased need for remote access by employees, customers, and stakeholders expands the attack surface, making it challenging to protect against unauthorized access and sophisticated cyberthreats.

The industry's ongoing dependence on manual processes for managing access also leads to substantial costs and poses considerable risks. Compounding these challenges are the strict regulatory requirements for data protection and privacy that the BFSI sector must navigate. Striking a balance between ensuring compliance, providing seamless online services, and maintaining customer trust in this rapidly evolving digital landscape is a complex yet vital task for these institutions.

Navigate the Future of Access Management

Watch the discussion between ManageEngine and KuppingerCole for a holistic view of access management in the age of hybrid identity and AI agents.

Watch on demandFeatures

identity risk assessmentMaximize BFSI security and efficiency

In the BFSI sector, traditional password-based authentication systems present significant security risks to both customers and employees. These systems not only jeopardize data security but also hinder productivity. Furthermore, when employees change roles or locations, the process of updating access rights becomes cumbersome and error-prone. By adopting AD360, banks can enhance their security measures and optimize operational efficiency, thereby enhancing trust and reliability among customers and regulatory bodies alike.

- Automate the process of updating access rights when employees in banks and financial organizations change roles or locations. This automation ensures that the correct permissions are always in place, thereby eliminating manual errors and security vulnerabilities.

- Enhance security in the BFSI sector by adopting adaptive MFA for access to financial services and digital platforms. This approach utilizes dynamic authentication protocols and offers personalized access experiences within the financial environment.

- Enable both employees and customers to manage their passwords independently. This self-service approach reduces the reliance on IT staff, allowing them to focus on more strategic tasks. This not only increases productivity but also ensures that password-related tasks are executed securely and promptly.

- Provide SSO access to various banking applications, eliminating the need for users to manage multiple login credentials. This simplifies accessibility and enhances security by reducing weak or compromised passwords. The result is increased productivity while safeguarding sensitive financial data.

Monitor and audit access activities

The banking sector handles a treasure trove of sensitive financial data, encompassing customer account information, transaction histories, and investment portfolios. This puts the BFSI sector in a high-stakes environment, where a single security breach could result in severe financial losses and reputation damage.

Therefore, maintaining a vigilant eye on who accesses confidential financial data, when, and from where is not just a priority but an absolute necessity. Yet, the reality is that IT admins often grapple with the formidable challenge of real-time monitoring of these critical access activities. AD360 protects sensitive information against unauthorized access and breaches.

- Enforce fine-grained access controls to manage user permissions, ensuring that only authorized personnel access specific banking resources. This reduces the risk of unauthorized entry and maintains trust with customers and regulatory bodies. Such access controls are fundamental for safeguarding sensitive financial data and ensuring compliance with industry regulations.

- Provide immediate alerts whenever any changes are made to sensitive financial data within the BFSI sector. Whether it's modifying account information or transaction records, these alerts specify who performed the change, the time it occurred, and the location from where the change was made. This real-time notification system is crucial for swiftly detecting and responding to potential security breaches, minimizing the risk of financial losses and reputational damage.

- Enable IT admins to keep a constant eye on who is accessing confidential financial data. It tracks user logins, access patterns, and any unusual or suspicious activities in real time. This continuous monitoring capability is essential for early detection of potential security threats, enabling proactive responses to mitigate risks effectively.

- Implement conditional access to allow only verified and authorized users, such as bank employees and customers, to modify passwords and update personal information. This strict control over data access safeguards customer privacy and ensures compliance with data protection regulations.

Enhance endpoint security management

In the BFSI sector, the security of endpoints, such as desktops, laptops, and VPNs, is paramount due to their access to sensitive financial data and proprietary algorithms. With a constantly evolving threat landscape, where attackers innovate effective methods to exploit vulnerabilities, the need for adaptive and robust IAM systems is more critical than ever.

The shift towards remote work and mobile banking has further decentralized access points, significantly expanding the threat surface and complicating endpoint security. Employees now access sensitive data from various locations and devices, adding complexity to internal access control and management. AD360 addresses these challenges through its adaptive MFA, enhancing login security across various platforms.

- Enhance BFSI IT systems with adaptive MFA, fortifying crucial logins such as Windows, macOS, Linux, VPN, and OWA. This ensures a robust defense mechanism against unauthorized access, crucial for safeguarding sensitive financial data.

- Customize authentication methods based on user behavior, location, and device. This approach tailors security protocols to individual user profiles, balancing stringent security measures with user convenience. This is especially relevant in high-stakes financial environments where user experience and rapid access are critical.

- Strengthen password security policies in BFSI systems by integrating with Have I Been Pwned?. This prevents users from setting previously compromised passwords, an essential feature for securing financial accounts and customer data.

Become PCI DSS compliant

Achieving PCI DSS compliance in the BFSI sector is a complex task, focusing on safeguarding financial data integrity, confidentiality, and availability. The PCI DSS sets rigorous standards for handling consumer credit card information, necessitating stringent security practices.

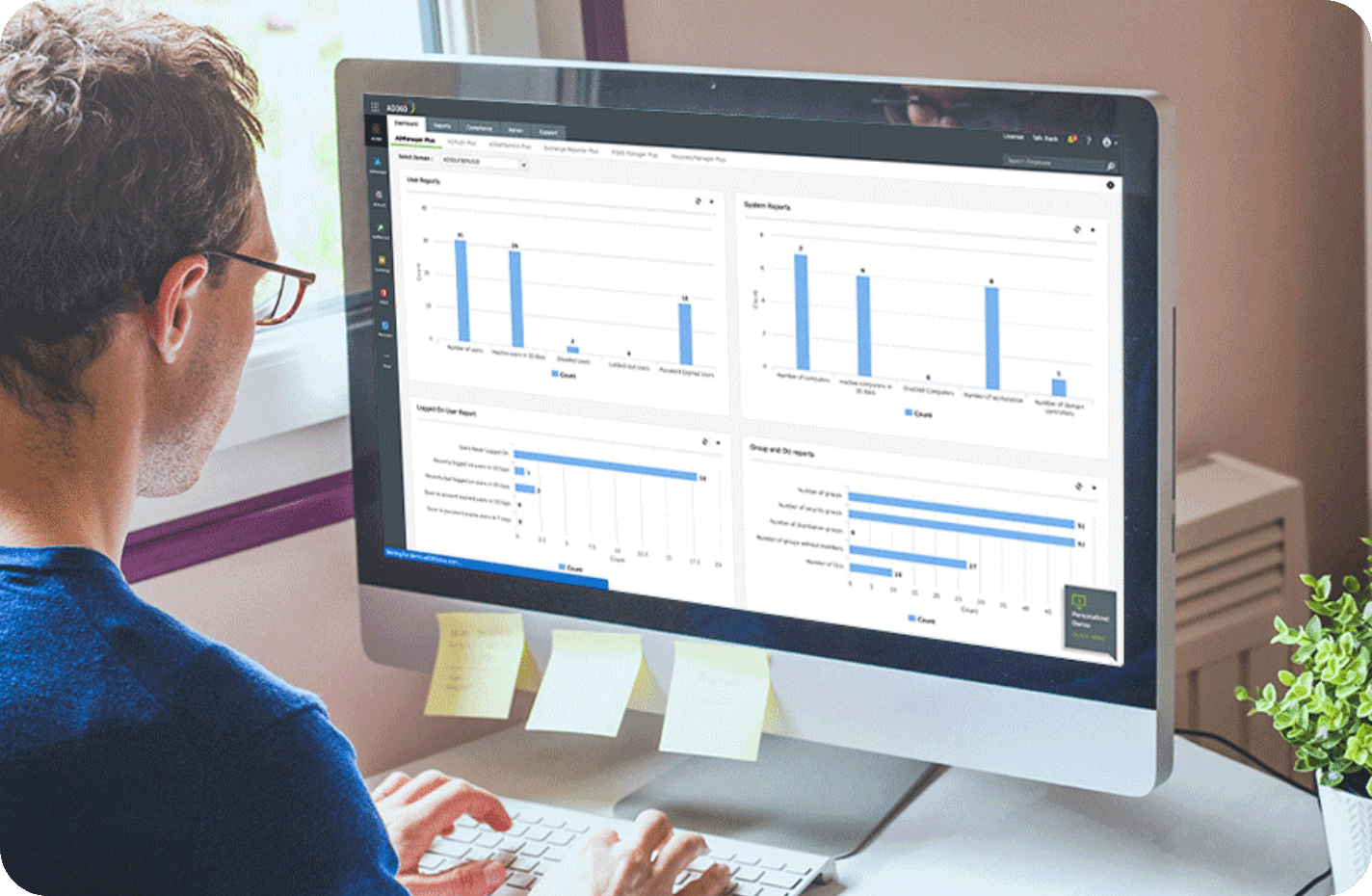

A significant challenge for admins is generating real-time compliance reports on key PCI DSS elements like logon attempts and file access. AD360 is a streamlined solution, providing audit-ready reports not only for PCI DSS but also for other critical financial regulations like FISMA, GLBA, and SOX. This tool simplifies compliance, ensuring financial institutions meet the high security standards required in the dynamic financial sector.

- Obtain over 150 preconfigured AD reports for the BFSI sector, including detailed login audits, folder permission checks, and group membership insights, enhancing data visibility and control.

- Implement workflow automation with a structured hierarchy of approvals, vital for error minimization in banking processes. This system aligns with banking-specific regulatory requirements, ensuring data protection and adherence to financial regulations like the PCI DSS, SOX and the GDPR.

- Improve compliance management in the BFSI sector with customizable reporting templates. Develop robust reporting systems for real-time monitoring of financial transactions and operational activities. This ensures timely detection and resolution of compliance risks, aligning with critical banking regulations.

Solution

Enhance security and compliance

Strengthen security measures and ensure regulatory compliance within the highly regulated BFSI sector. This includes safeguarding sensitive financial and personal data from cyberthreats and ensuring adherence to industry-specific regulations.

Advanced identity analytics for fraud detection

Leverage machine learning algorithms to monitor and analyze user behavior, helping to detect and prevent fraudulent activities within financial institutions.

Streamline employee identity management

Simplify employee identity management, ensuring that only authorized personnel have access to critical systems and customer data. This is vital for preventing data breaches and fraudulent activities.

Automate identity and access management

Automate complex processes such as user provisioning, deprovisioning, and access rights management, reducing administrative overhead and human error in sensitive BFSI environments.

Improved operational continuity

Gain granular backup and quick recovery options, ensuring minimal disruption to financial services in case of data loss or other disruptions.

Seamless integration with BFSI systems

Integrate seamlessly with existing BFSI systems, creating a cohesive environment that enhances operational efficiency and the user experience.

Facilitation of secure remote access

Enable secure and flexible remote access for employees, and adapt to the evolving work-from-anywhere trend in the BFSI sector while maintaining strict security protocols.

SSO for simplified access

Simplify access to various BFSI applications with SSO, enhancing the user experience by reducing multiple credentials.

Case studies

AD360 unburdens Indian Overseas Bank's IT help desk teams

Indian Overseas Bank, established in 1937, is a major public sector bank in India, with over 3,200 domestic branches and additional international presences.

"Thankfully the solution has helped our department receive fewer calls for password reset/enable, and users are very comfortable performing this activity."

- Shaik Zaman, Assistant Systems Manager, Indian Overseas BankBusiness challenges

The bank's sysadmin team was overwhelmed by the volume of password-reset-related calls, which impacted their ability to address more critical IT issues.

How AD360 helped

Indian Overseas Bank implemented the self-service password management module of AD360, allowing employees to reset passwords and unlock accounts independently, significantly reducing help desk calls.

The implementation led to a notable decrease in help desk calls for password resets, enhancing end-user satisfaction and administrative efficiency.

Read the full storyAD360 streamlines user onboarding and offboarding for Ensurem

Ensurem, an insurance marketplace, aims to simplify the insurance buying process for consumers by leveraging technology.

"The automation of critical AD tasks like user onboarding and offboarding has significantly reduced our IT team's workload."

- David Rich, CEO at EnsuremBusiness challenges

The IT team realized they were spending a substantial amount of time on repetitive IT tasks that could easily be automated. The team also found it cumbersome to manage their Exchange server's distribution list.

How AD360 helped

They implemented the AD management component of AD360, which facilitated automated user onboarding and offboarding, and simplified the management of user permissions and access.

The deployment of AD360 led to a significant reduction in manual work for the IT team, allowing for a more efficient management process and better resource allocation.

Read the full storyAD360 elevates operational efficiency for Central Bank

Central Bank, founded in 1902 with over $20 billion in assets, operates across 13 markets in 8 states and is recognized among America's Best Banks by Forbes.

""[AD360] has revolutionized our approach to user provisioning and deprovisioning, making our routine IT processes more efficient and error-free."

- Jerry Kolb, IT Administrator, Central BankBusiness challenges

Central Bank struggled with manual and script-based processes for user account management, leading to inefficiencies and potential for errors.

How AD360 helped

The bank adopted the AD management module of AD360 for its user-friendly, automated workflows for user lifecycle management, integrating seamlessly with its existing HR systems.

Implementing AD360 significantly streamlined user account operations, reducing manual efforts and improving overall IT productivity.

Read the full storyLibro Financial Group enhances user management with AD360

Libro Financial Group, a financial institution based in London, Ontario, Canada, has been operational since the early 1950s. Known for its comprehensive range of financial products, Libro focuses on the well-being of its community and boasts an asset value of over $1 billion.

"AD360's reporting features and its integration with various parts of AD and other systems are beneficial. The console's manageability by other team members is another advantage."

- Andrew Tennant, Libro Financial GroupBusiness challenges

Libro needed to maintain high-security standards and manage user permissions effectively, especially for system resources like printer and USB port access.

How AD360 helped

After evaluating several options, Libro chose AD360 for its ability to create flexible policies and its extensive reporting capabilities, which addressed their user and device management challenges.

AD360 simplified and automated Libro's user management processes, significantly aiding in Active Directory management. The solution also provided detailed reports to track Active Directory objects and manage security and compliance more effectively.

Read the full story