On this page

The financial services industry is under constant threat of cybercrime. Due to the sensitive nature of the data handled, the financial implications of security breaches, and the need to maintain customer trust and regulatory compliance, it's crucial for the banking, financial services, and insurance (BFSI) sector to strengthen its cybersecurity posture.

Equipped with advanced technologies, criminals are shifting their focus from low-risk, low-profit individual bank customers to the banking service providers themselves. The risks involved with high-profile targets like these are far greater, but so is the reward. A cybersecurity solution with user and entity behavior analytics (UEBA) capabilities can go a long way in ensuring data security in the banking and financial industry.

What is cybersecurity in the finance industry?

Cybersecurity in the banking and finance industry refers to the practices, technologies, and measures implemented to protect banking systems and financial institutions and their data and networks from cyberattacks. This is crucial for maintaining the confidentiality, integrity, and availability of financial information.

What is the importance of cybersecurity in financial services?

Cybersecurity is crucial in the banking and financial services industry for the following reasons:

Protecting sensitive data: BFSI institutions manage vast amounts of sensitive personal and financial data, including customer identities, account details, transaction histories, and financial records. It's crucial to ensure the confidentiality and integrity of financial transactions. Implementing a SIEM solution with UEBA capabilities and adopting cybersecurity measures like encryption, secure transaction protocols, and access control are essential to protect this data from breaches and unauthorized access.

Financial stability: Cyberattacks on BFSI institutions can lead to significant financial losses, both for the institutions and their customers. Effective cybersecurity helps prevent fraudulent transactions, theft, and financial loss, and ensures the financial stability of the organization.

Regulatory compliance: The BFSI sector is heavily regulated, with stringent requirements for data protection and cybersecurity. Regulations such as the General Data Protection Regulation (GDPR), the Payment Card Industry Data Security Standard (PCI DSS), the Sarbanes-Oxley Act (SOX), and sector-specific standards like the Federal Financial Institutions Examination Council (FFIEC) guidelines in the United States, mandate strict security controls and reporting requirements. Robust cybersecurity practices ensure that institutions meet these regulatory requirements while avoiding penalties and legal repercussions.

Business reputation and customer trust: Customers trust BFSI institutions to safeguard their personal and financial information. A data breach or cyberattack can severely damage this trust, leading to loss of customers and reputational damage. Customers are more likely to choose—or switch to—institutions that are known for their robust security measures.

Risk management: The BFSI sector is inherently risk-sensitive, and cybersecurity is a critical component of risk management. Identifying, assessing, and mitigating cyber risks helps institutions manage their overall risk profile and protect their assets. Institutions should also factor in third-party risks and ensure that partners and vendors adhere to their security standards.

Operational continuity: Cyberattacks can disrupt business operations, leading to downtime and loss of services. Deploying effective cybersecurity tools like a UEBA solution or UEBA-integrated SIEM solution can help identify and prevent fraudulent activities and financial crimes. It can also help financial institutions respond to and recover from security incidents quickly, maintain business continuity, and minimize operational disruptions.

What cybersecurity threats do the finance industry face?

While there are numerous threats, the five most popular cybersecurity threats to the financial sector are:

Phishing attacks: Phishing is when attackers send deceptive emails or messages to trick recipients—employees, vendors, partners, or even customers—into revealing sensitive information, such as login credentials or financial details. Globally, around 27.32% of all phishing attacks in 2023 targeted financial institutions.

Ransomware: This is when attackers encrypt the financial organization's data and render it inaccessible until a ransom is paid. This can severely disrupt operations and lead to significant financial and reputational damage. In 2023, 64% of financial services organizations were the target of ransomware threat actors, and almost 39% of them paid a ransom of $1M or more.

Advanced persistent threats (APTs): APTs are sophisticated, prolonged attacks where cyberattackers gain unauthorized access to a network and remain undetected for extended periods. They typically target high-value assets and can lead to substantial data breaches. Multiple sources like Kaspersky and Cyfirma report that financial organizations were the target of APT attacks in 2023.

Insider threats: These attacks stem from employees or contractors who misuse their access to sensitive information, either intentionally or unintentionally. As these attacks can be a result of malicious, negligent, or compromised insiders, it is particularly challenging to detect and prevent these threats. The finance sector suffers the most from insider threats, with average annual insider risk costs reaching $14.5 million. The average cost of a data breach in this industry is also among the highest—$58.85 million, to be precise!

Distributed denial of service (DDoS) attacks: Here, attackers overwhelm the bank or the financial institution’s online services with excessive traffic, causing disruptions and rendering services unavailable to legitimate users including online banking and trading services. In 2023, 35% of all DDos attacks targeted financial services institutions.

A UEBA-integrated SIEM solution like ManageEngine Log360 can help combat these and other threats faced by the financial industry.

How to fortify cybersecurity in financial services with UEBA

UEBA, or anomaly detection, employs ML algorithms to analyze historical data, establishing a baseline of normal or expected behavior for users and entities. In banking and financial institutions, this can include identifying typical login times, frequently accessed resources, usual transaction patterns, and regular network activities. By understanding what constitutes normal behavior, UEBA solutions are better positioned to identify anomalous activities indicative of security threats and alert you in real time.

With its advanced analytics capabilities, UEBA can detect various cyberthreats, such as DDoS, ransomware, APTs, and zero-day attacks. UEBA is particularly effective at identifying insider threats by monitoring the activities of privileged users who have access to critical systems and data. With its early identification of threats, UEBA enables a more proactive defense, preventing attackers from establishing a foothold in the network.

UEBA can monitor transaction patterns for signs of fraudulent activity, such as access to sensitive data at odd hours, unusual transaction sizes or frequencies, and flag them for further investigation. In this way, it helps prevent financial losses and protects the integrity of financial transactions. With its accurate risk scoring ability, UEBA enables security teams to prioritize threats and focus their efforts on addressing the most urgent. UEBA solutions continuously learn and adapt to new behaviors and ensure that the organization’s security posture remains robust in the face of evolving cyberthreats.

To further understand how UEBA can help BFSI organizations, let's look at a few examples.

Examples of UEBA in financial services

UEBA can help ensure data security in the banking industry and cybersecurity in financial services. The following examples illustrate the role of UEBA in the BFSI sector.

Detecting spear phishing attacks: It's just another day at work for Margaret, marketing manager at Alpha Financial Inc. She's expecting a quote for a proposed television campaign from an advertising agency. As anticipated, an email notification pops up on her screen, and she quickly skims through the content and downloads the attachment. She doesn't realize that she has just fallen prey to a spear phishing attempt.

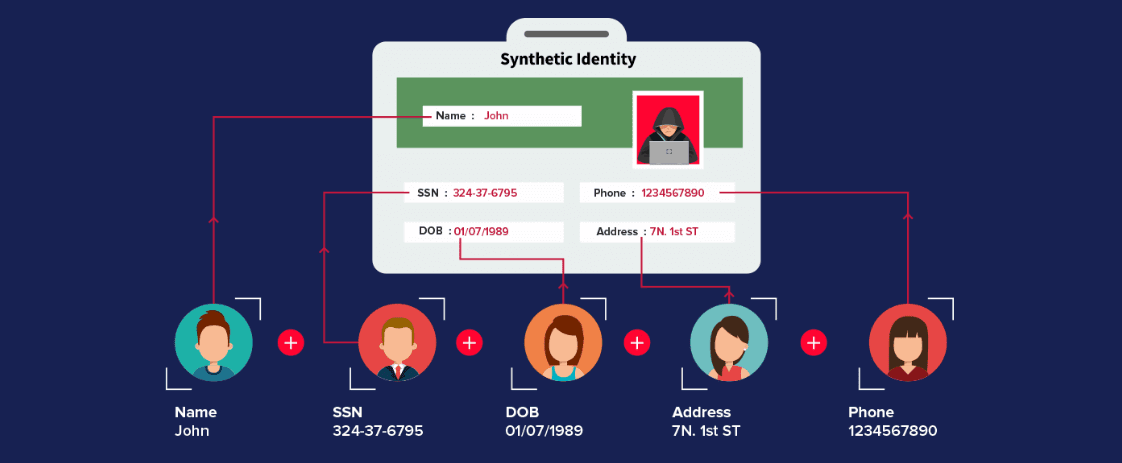

With an email address that closely resembles the ad agency's and relevant mail content, Margaret can't really be blamed. Once she opens the Word document, the macro in the document begins running multiple commands in PowerShell to exfiltrate the customer database by copying and mailing it to the hackers. The stolen data will then be used to perform synthetic identity fraud.

Making of a synthetic identity

Fortunately, in this case, the attack is subdued. Before the data can be wired to the hacker via email, Alpha Financial's UEBA solution flags the execution of multiple cmdlets in PowerShell and the accessing and copying of numerous folders in a short span of time as atypical behaviors. Once Margaret's risk score shoots up, the IT administrator notices and promptly secludes the system from the internet and the company's network to prevent lateral movement inside the bank's network and outward data transmission.

Preventing DDoS attacks: It's a regular business day at Omega Bank, a leading financial institution known for its robust online banking services. Unbeknownst to them, a group of cybercriminals have orchestrated a botnet consisting of compromised devices from around the world. Their plan is to launch a DDoS attack by flooding Omega Bank’s online services with massive traffic, rendering it unavailable to legitimate customers.

Fortunately, Omega Bank has implemented a comprehensive UEBA solution to monitor and analyze user and network behavior in real-time. The solution flags the unusual traffic volume, noting that the sudden increase in connections is far beyond the normal range observed, even during peak banking hours. It then alerts Olivia, a senior IT security analyst, of the potential DDoS attack. Olivia and her team then take actions such as rate limiting, geo-blocking, and traffic filtering to mitigate the attack. By leveraging UEBA for proactive threat detection, Omega Bank ensures the proper functioning of their online banking services, and their customers are able to carry out transactions without any issues.

Detecting insider threats: Andrew is a highly sought after financial adviser employed in the private wealth management division of Goldguard Holdings. Goldguard Holdings uses a relational database management system, Oracle Database, to consolidate client information. Fueled by greed, Andrew decides to launder money.

Andrew's money laundering plan:

- Identify bank accounts that have been dormant for a while.

- Disable notifications to owners of these accounts, so they remain unaware of their account transactions.

- Deposit the illegally obtained money in small amounts into the victims' accounts.

- Redirect the money back to the originating account.

- Delete transaction traces.

- Repeat the process at safe intervals that won't arouse suspicion.

His plan looks impressive, but unfortunately, it quickly flops, landing him behind bars. Andrew doesn't know that Goldguard Holdings has a UEBA solution in place to monitor its IT infrastructure.

Here's how the UEBA solution protected Goldguard Holdings and its customers: Andrew had permission to access the database of all the customers of the bank. However, he had only previously accessed basic details of his clientele. Once he started performing several queries on the customer database to identify accounts that have been idle for one year, the UEBA solution detected a count anomaly. Following this, when he shortlisted scapegoats and began altering account notification permissions, it detected a pattern anomaly.

In response, Andrew's risk score shot up, alerting the system administrator of a potential breach. The administrator was able to investigate and uncover Andrew's illicit activity. Had the UEBA solution not reported Andrew's malicious activities, Goldguard Holdings would have been on the hook for an anti-money laundering compliance violation and subject to legal and financial repercussions.

Related solutions

ManageEngine AD360 is a unified IAM solution that provides SSO, adaptive MFA, UBA-driven analytics, and RBAC. Manage employees' digital identities and implement Zero Trust and the principles of least privilege with AD360.

To learn more,

Sign up for a personalized demoManageEngine Log360 is a unified SIEM solution with UEBA, DLP, CASB, and dark web monitoring capabilities. Detect compromised credentials, reduce breach impact, and lower compliance risk exposure with Log360.

To learn more,

Sign up for a personalized demoThis content has been reviewed and approved by Ram Vaidyanathan, IT security and technology consultant at ManageEngine.