Amazon VPC (Virtual Private Cloud) is utilized in the banking and financial industry to create safe, scalable, and compliant infrastructure for a variety of services and applications. The following section is an example use case that shows how Amazon VPC can be applied in banking and finance.

Use case: Secure payment and processing with Amazon VPC

Processing credit card transactions, internet payments, and other financial transactions securely is necessary for financial institutions like banks and payment processors. These organizations also need to ensure that they comply with regulatory standards like the Payment Card Industry Data Security Standard (PCI DSS). This financial institution requires a robust and scalable infrastructure for hosting its payment processing systems and applications, while safeguarding sensitive payment data from unauthorized access or data breaches.

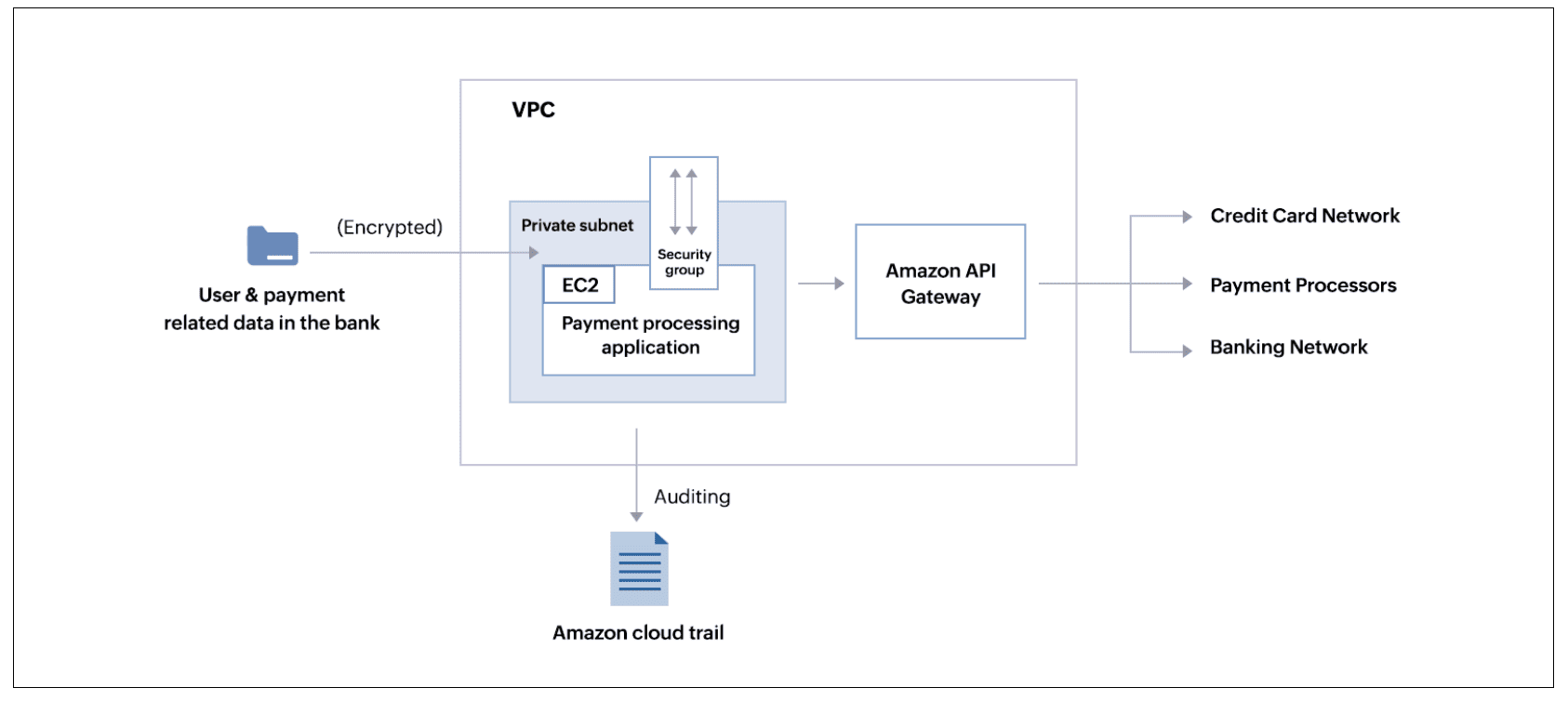

There are several ways how Amazon VPC can be implemented, which will be explored in this scenario (Refer to Figure 1 for an overview).

Figure 1: Amazon VPC in banking and finance

1. Creation of a dedicated Amazon VPC environment

In this example, the bank sets up a specific Amazon VPC to host its environment for processing payments. Sensitive payment data is isolated from the public internet by configuring the VPC with private and public subnets. Security groups, network access control lists (NACLs), and AWS Identity and Access Management (IAM) rules are used to manage access to resources inside the VPC.

2. Deployment of payment processing applications

The financial institution deploys its payment processing applications within the VPC. Applications in charge of processing payments, authorizing transactions, and managing customer accounts fall under this category. To keep sensitive payment data off the public internet, the payment processing apps are hosted on Amazon EC2 instances or containers in private subnets.

3. Integration with payment gateways and services

The financial institution incorporates external payment gateways and services—including payment processors (like PayPal and Stripe), credit card networks (like Visa and Mastercard), and banking networks (like Automated Clearing House)—into its payment processing applications. Through this integration, the organization can abide by industry standards and regulations while safely transmitting payment data between internal systems and external payment networks.

4. Data encryption and tokenization

To prevent unwanted access or interception of critical payment data, the financial institution uses tokenization and encryption techniques within the VPC. In order to lower the risk of exposure in the case of a breach, this involves employing tokenization techniques to replace sensitive data with non-sensitive tokens and encrypting payment data—both in transit and at rest—using AWS Key Management Service (KMS).

5. Security and compliance

To identify and address security risks and ensure compliance with legal requirements like PCI DSS, the financial institution deploys security monitoring and compliance procedures inside the VPC. This includes regular security audits and assessments to find and fix possible vulnerabilities, as well as tracking and monitoring of access and activity via AWS CloudTrail.

Here are the benefits gained by the financial institution by employing Amazon VPC

- Enhanced security: Through the implementation Amazon VPC hosting, the financial institution can fortify its payment processing environment and safeguard confidential payment information against unwanted access or security breaches.

- Scalability and reliability: Amazon VPC allows the financial institution to scale its payment processing infrastructure up or down based on demand, ensuring the availability and responsiveness of payment processing services during peak usage periods.

- Regulatory compliance: By putting in place suitable security controls and audit procedures within the VPC, the financial institution may comply with regulatory standards like PCI DSS and lower the risk of fines and penalties for non-compliance.

Ready for the next step?

Explore how you can protect your organization's sensitive information from being misused. Sign up for a personalized demo of ManageEngine Log360, a comprehensive SIEM solution that can help you detect, prioritize, investigate, and respond to security threats.

You can also explore on your own with a free, fully functional 30-day trial of Log360.