- HOME

- Digital Transformation

- Seven important risks every organization should monitor

Seven important risks every organization should monitor

- Last Updated: November 7, 2024

- 934 Views

- 6 Min Read

Think your business is safe? Think again. In a world where data breaches occur every 39 seconds, the importance of risk management cannot be overstated. Even a minor data breach can potentially compromise sensitive customer information and lead to a damaged reputation and millions in losses, which can erode customer trust and partnerships.

According to Boston Consulting Group (BCG), only 37% of companies with low-risk management capabilities understand the importance of risk management and how crucial it is during a crisis. Business risks are inevitable, and being well prepared is essential for effectively tackling these challenges.

The benefits of effective risk monitoring include improved decision-making, enhanced operational resilience, and the ability to capitalize on opportunities amidst uncertainty. This blog will explore various categories of risks, including: compliance, operational, cybersecurity, financial, people, reputational, and macroeconomic.

What is a business risk?

The exposure of an organization to circumstances that could reduce its profits or force it into bankruptcy are known as business risks. A business risk is anything that could jeopardize the company's capacity to meet its financial targets. Understanding business risks is essential for any organization because it helps with better decision-making and planning. By actively recognizing and managing these risks, organizations can become more resilient, adapt to market changes, and secure their future in a competitive ecosystem.

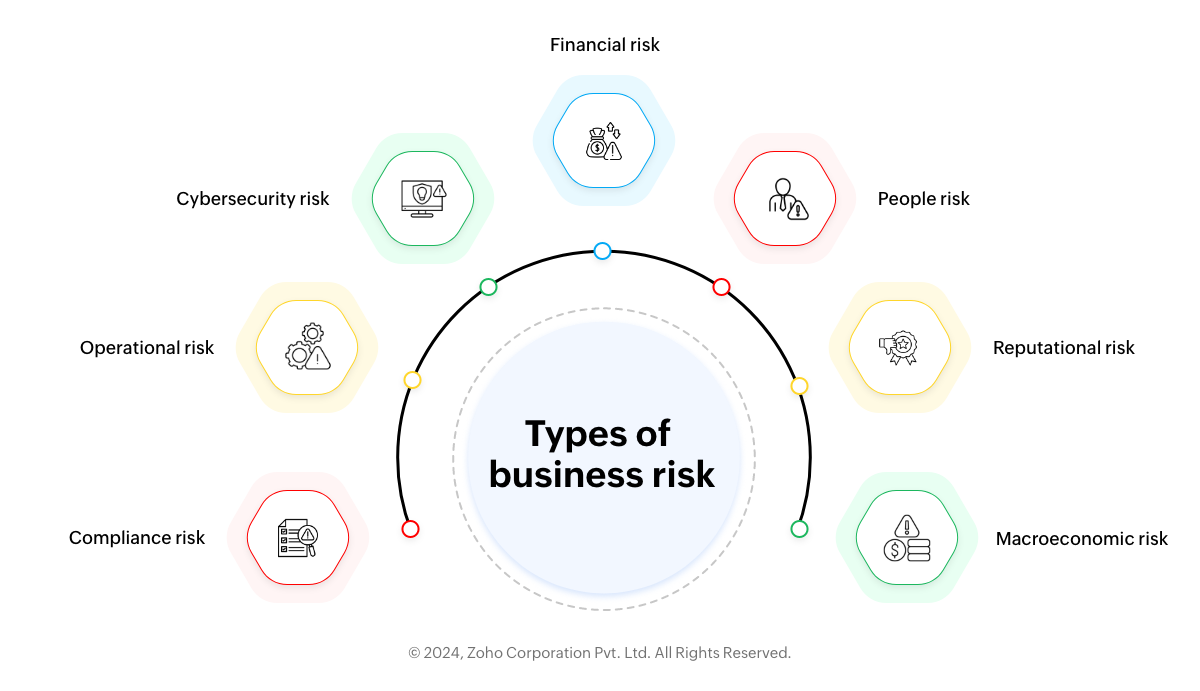

Types of business risk

Understanding risk categories will help organizations effectively manage resources, prioritize activities, and develop strategies to mitigate potential impacts and improve the overall resilience of the company. After establishing the importance of understanding and categorizing business risks, let’s explore some of the different types of risks, and how each can impact the overall performance of a business.

1. Compliance risk

Compliance risk signifies the potential for an organization to incur legal penalties, monetary losses, or reputational harm due to a violation of laws, regulations, and industry standards. An organization facing this risk could face hefty fines, operational disruptions, and poor relationships with customers. For example, a company that overlooks data protection regulations may face lawsuits due to a data breach and lose customer confidence, leading to long-term financial setbacks. Organizations can ensure regulatory adherence, protect their reputation, and maintain a competitive advantage in their sector by proactively managing compliance risk through regular audits.

2. Operational risk

Operational risk encompasses the potential losses an organization might face due to flawed internal or external processes, policies, systems, or events. This can range from technical malfunctions to fraud and supply chain disruptions. For example, a breakdown in supply chain logistics can halt production and delay delivery, affecting customer satisfaction. To manage operational risk effectively, organizations should focus on building robust operational systems and processes, conducting regular risk assessments, and investing in employee training. Furthermore, having backup plans in place enables companies to react quickly to unexpected challenges.

3. Cybersecurity risk

Cybersecurity risks signify the potential risk of financial loss, disruption, or damage to the reputation of an organization from some kind of failure of its information technology systems. Over the years, the risk of cyberattacks, such as data breaches, ransomware, and phishing scams, has escalated dramatically. Organizations should invest in strong security measures, such as firewalls, encryption, and regular security audits, to reduce cybersecurity risk. Businesses can protect their assets and create a secure environment for their stakeholders and customers by prioritizing cybersecurity.

4. Financial risk

The concept of financial risk explains the possibility of losing money or facing unfavorable financial outcomes due to various factors, including market fluctuations, credit issues, and operational challenges. For businesses, this risk can arise from fluctuations in interest rates, changes in currency values, or defaults by customers and suppliers. For instance, a decline in the market may result in fewer sales and income, while an increase in interest rates may result in higher borrowing costs, hence negatively impacting cash flow. Businesses should put effective financial procedures into place, such as conducting thorough credit assessments and maintaining robust cash reserves, to minimize financial risk.

5. People risk

People risk involves the challenges and losses organizations face due to workforce issues, such as high turnover, skill gaps, poor performance, and misconduct. If not managed well, these risks can harm productivity, morale, and overall success. For instance, high employee turnover increases training and recruitment costs. To mitigate people risk, organizations should cultivate a positive work environment, invest in employee development, and encourage open communication. Regular performance evaluations and feedback help identify issues early. By prioritizing people risk management, businesses can boost employee satisfaction, retain talent, and improve performance, leading to long-term success.

6. Reputational risk

The term reputational risk defines the potential loss an organization faces when its reputation is damaged due to negative perceptions from customers, stakeholders, or the public. This can result from various factors, including poor customer service, ethical breaches, or negative media coverage. A damaged reputation can lead to decreased customer trust, lost sales, and a decline in market share. For example, a company involved in a scandal may see its stock prices drop and struggle to attract new customers. Upholding a positive reputation can be achieved in part by fostering close bonds with clients, promptly handling negative comments, maintaining ethical corporate procedures, and routinely observing public opinion.

7. Macroeconomic risk

Macroeconomic risk refers to risks associated with political, social, or economic disturbance that may harm the businesses operating within a country. Risks, such as inflation, recession, and interest rate fluctuations, can significantly impact businesses. They influence consumer spending, borrowing costs, and overall market stability. Businesses must adapt by diversifying revenue streams, enhancing cost management, and staying informed about economic trends to moderate potential negative impacts on the business.

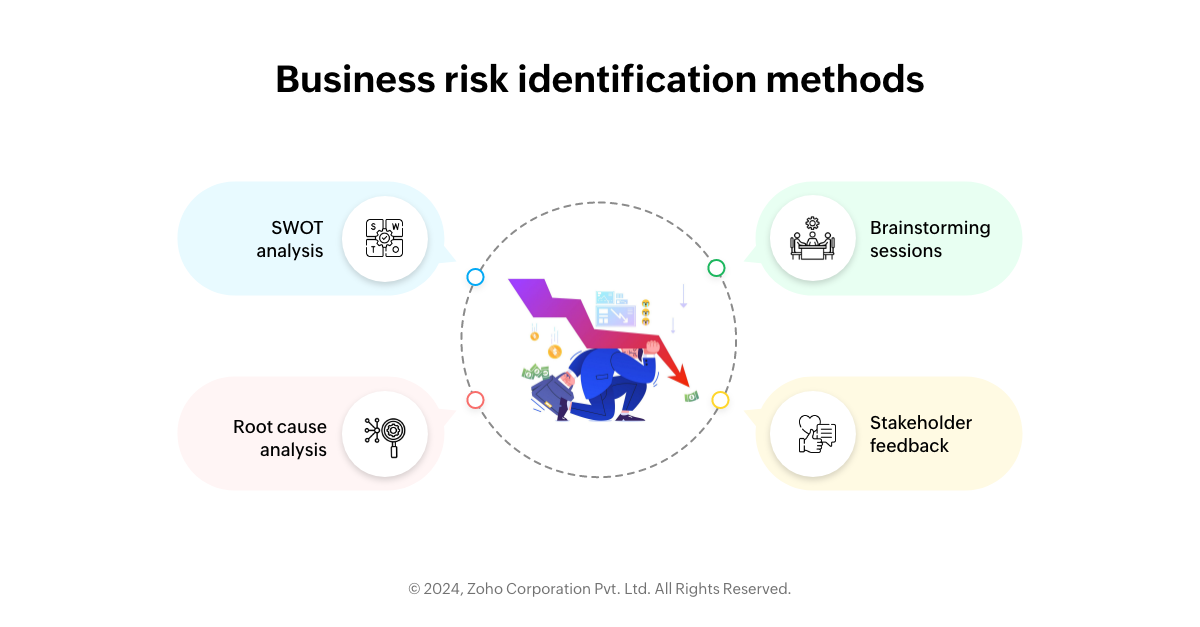

How to identify business risks

To identify risks effectively, organizations can leverage methods like:

- SWOT analysis: This is a process that evaluates strengths, weaknesses, opportunities, and threats to help pinpoint internal and external threats to the business.

- Root cause analysis: Examines the cause of previous project risks to understand what led to the risk and how to avoid it in the future.

- Brainstorming sessions: Encourages team discussions to uncover potential risks collaboratively.

- Stakeholder feedback: Involves insights from employees, customers, and partners for a holistic view of the possible risks the business may encounter.

Strategies for monitoring business risks

Following identification, risks must be tracked so that management may take swift action if and when the risk's nature or possible consequences go outside acceptable levels. Here are a few strategies for monitoring risks:

- Setting clear objectives: Clearly defined goals ensure focused strategies, timely responses, and improved decision-making.

- Key risk indicators (KRIs): Use measurable metrics such as monthly sales growth, website traffic, and customer retention rate to track financial, operational, and data-related risks.

- Monitoring tools and technologies: Advanced technology and monitoring tools improve risk identification, simplify reporting, and encourage proactive decision-making.

- Regular risk reviews and assessments: Continuous data collection and analysis provide insights that are crucial for adjusting strategies and mitigating risks promptly.

By prioritizing the identification and monitoring of business risks, organizations can build a robust framework for proactive risk management.

Best practices for managing business risks

Adopting best practices in risk management ensures organizations can effectively evaluate and respond to potential challenges. These are some best practices for effective risk management:

- Recognize and rank risks: Identify and prioritize risks based on their potential impact on the business.

- Implement mitigation strategies: Develop contingency plans, enhance security measures, and adjust processes as needed to mitigate risks effectively.

- Adapt to emerging challenges: Continuously track risks and evaluate mitigation strategies to address new challenges.

- Learn from experience: Conduct post-incident reviews to analyze successes and failures in strategies.

- Foster continuous improvement: Cultivate a culture of ongoing enhancement in risk management practices.

How does ManageEngine AppCreator help to mitigate business risks?

Risk monitoring tools using advanced technology can boost your risk identification process. ManageEngine AppCreator, a low-code custom application development platform is equipped with features that can be leveraged to enhance risk management capabilities.

One of its standout features? Dashboards that display real-time insights on performance metrics and risk indicators, enabling timely decision-making when a crisis arises. In addition, AppCreator has an access control feature, that ensures that sensitive data is secure and only accessible to authorized users.

Furthermore, AppCreator's task automation minimizes manual errors, allowing the stakeholders to focus on strategic initiatives. With seamless integration into existing ManageEngine applications, AppCreator creates a unified risk management framework that aligns all parts of the organization. Custom reporting tools allow for in-depth analysis of risk areas for clear decision-making.

In any business, there is no secret formula to avoid risks completely. However, businesses can put risk management strategies into place, which can help organizations reduce the overall impact of risks when they arise. ManageEngine AppCreator offers powerful features that help organizations tackle these risks with real-time insights, task automation, and compliance support. So lets get started, download AppCreator and check out these features today!